Redefining Success Beyond the Classroom

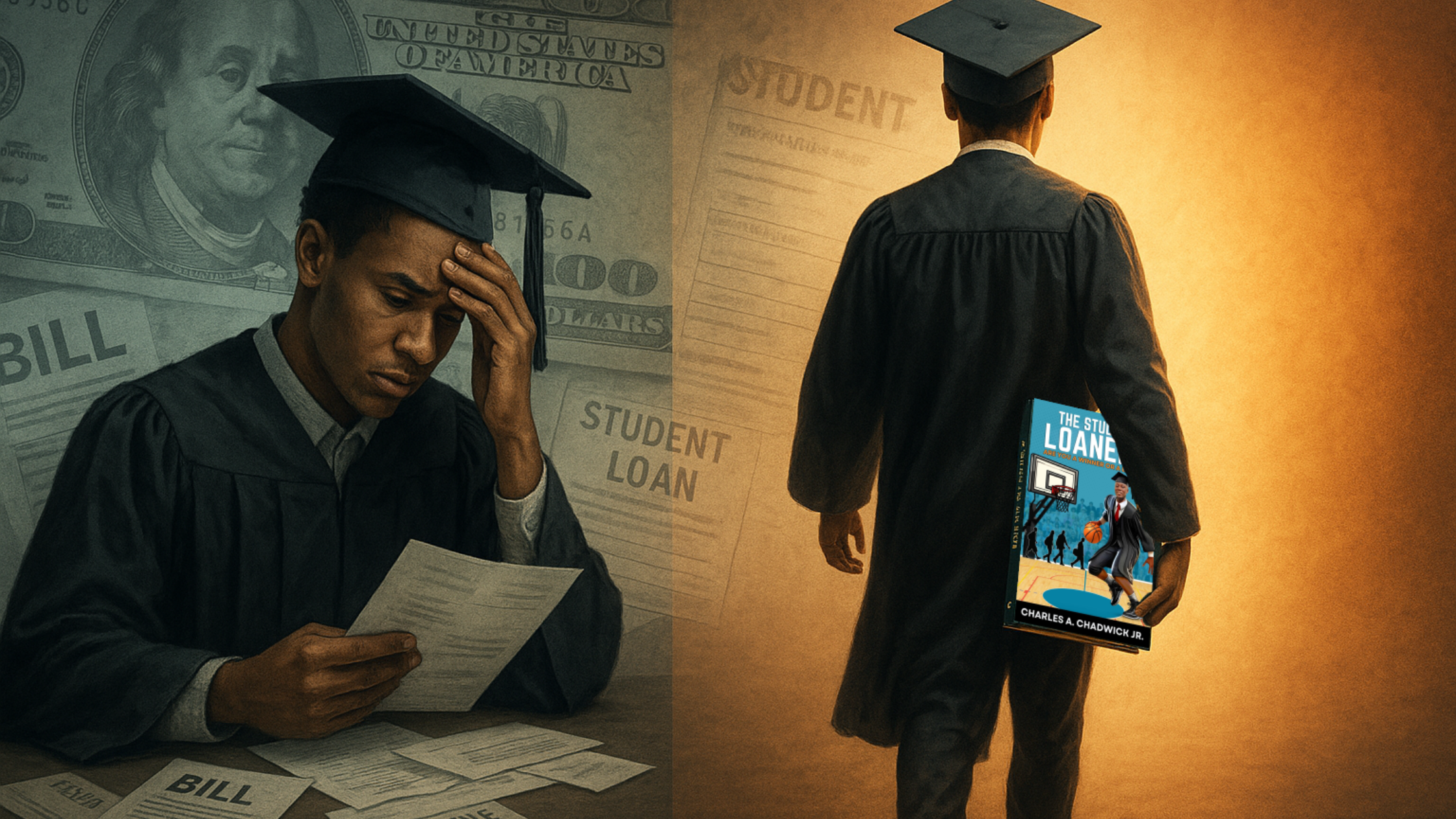

College isn’t just about lectures, clubs, or GPAs anymore. Today, it’s one of the biggest financial commitments a young adult makes—and the true costs often go unspoken. Charles A. Chadwick Jr., author of The Student Loaners: Are You a Winner or a Loser?, introduces a term that every student and parent should know: Student Loaner.

A Student Loaner is anyone who signs a legally binding contract to borrow money for college—essentially joining Team Student Loans.

What seems like a harmless agreement is actually the start of a long, high-stakes financial game.

What They Don’t Tell You: Financial Scoreboard After Graduation

Your GPA isn’t the scoreboard that counts—it’s your post-college financial health. While student loans may help you graduate, repayment is a solo mission. Despite media hype around forgiveness programs, these are temporary fixes, not real solutions.

Wage garnishment: Up to 15% of your paycheck

Tax refund seizures: Up to 100% of your federal refund

Retirement garnishments: Even Social Security isn’t safe

Starting June 2025, the Department of Education will begin collecting from Social Security checks of borrowers in default.

College Is Just the Camp, Not the Championship

Think of college like a basketball training camp. It preps you, equips you—but life after graduation is the real season. And many aren’t prepared for:

Budgeting

Debt management

Credit health

“Loan forgiveness is a bailout, not a breakthrough.” – Charles A. Chadwick Jr.

This is a game where only those with strategy win.

Shoot Your Shot—But Don’t Forget to Follow Through

Every student stands at the free-throw line when they take out a loan. The real question: Do they know how to follow through?

Kobe Bryant’s legendary free throws came from focus, discipline, and consistent follow-through—just like successful loan repayment requires.

In life, the follow-through is financial literacy.

That means:

Sticking to a budget

Building savings

Avoiding lifestyle inflation

Prioritizing loan repayment

Financial education should be taught before loans are signed—not after defaults occur.

Related Reads to Deepen Your Game

Ready to Win the Game?

It’s time to stop hoping the rules change. Instead, learn how to master the game.

Explore The Student Loaners: Are You a Winner or a Loser? for real strategies on:

Navigating student loans

Becoming debt-free

Building generational wealth

Grab your copy now: Visit Book Page

Final Thoughts

Success in college isn’t defined by your degree—it’s defined by how you manage the debt that comes with it. Become more than just a graduate. Be a Student Loaner who wins.

FAQs

A Student Loaner is someone who takes out student loans to pay for college. The term redefines borrowers as players in a high-stakes financial game that starts the moment they sign a loan agreement.

It depends. For some, the return on investment pays off. But many graduates find themselves struggling with debt and underemployment. That’s why understanding your financial options before borrowing is critical.

Begin with budgeting, make extra payments when possible, consider loan consolidation (if appropriate), and avoid lifestyle inflation. These strategies help reduce the long-term financial burden.

Yes. While forgiveness programs exist, they’re often limited. Real solutions include financial literacy, choosing lower-cost education options, trade skills, and proactive loan management.

Start by learning to budget, understanding credit, minimizing loan amounts, and working part-time or through work-study programs. Early financial literacy can prevent long-term debt problems.