When most people hear the word casino they think of risk. They think of flashing lights, loud noises, and the very real possibility of losing everything in their wallet. Parents warn their kids to stay away from gambling. Financial advisors say “Do not gamble what you cannot afford to lose.”

Yet millions of families walk straight into a much bigger gamble every single year. They do it without reading the fine print. They do it with a smile.

That gamble is college.

It might sound harsh but look at the mechanics. College operates exactly like a casino. The only difference is that the odds are hidden, the dealers stay silent, and the losses follow you for decades.

Actually there is one other major difference. In a casino you can actually win money. In college you must earn it after you are already deep in debt.

In this article we are going to break down the odds. We will look at why the “House” always wins in higher education and how you can flip the script to stop gambling and start investing.

The Biggest Gamble Americans Never Talk About

Imagine walking into a Las Vegas casino. You sit down at a blackjack table. But the dealer refuses to tell you the rules. You ask “What are the odds of winning?” The dealer shrugs. You ask “How much will this hand cost me?” The dealer says “We will tell you in four years.”

You would never play that game. You would stand up and walk out.

But this is exactly what happens in the American education system.

In a Casino: You know the cost of entry. You know the odds. You know when to walk away.

In College: You do not know if your degree will pay off. You often do not know your total loan balance until graduation. And you cannot walk away without consequences.

Casinos are required by law to post signs that say “Know Your Limits.” Colleges post banners that say “Follow Your Dreams.” One is a warning. The other is marketing.

The Myth That College Guarantees Success

For decades Americans were sold a simple story. Go to college. Get a good degree. Get a good job. Live comfortably.

That promise is broken. Today degrees are common rather than rare. Wages have stagnated while tuition continues climbing. As I discuss in my article on College Tuition Markup, the price of the degree has skyrocketed while the value has dropped.

A diploma without market demand is like betting big on a slot machine that has not paid out in years. You keep feeding it money hoping for a jackpot that never comes.

Student Loans The Only Debt You Cannot Walk Away From

If you lose $50,000 at a poker table it is a tragedy. But you have options. You can walk away. You can negotiate. In the worst case scenario you can declare bankruptcy and get a fresh start after seven years.

If you lose $50,000 on a degree that does not get you a job you are trapped.

Student loans are unique. They are sticky.

They follow you for life.

They can lead to wage garnishment.

The government can seize your tax refunds and even your Social Security.

That is not education. That is a lifetime contract signed by teenagers who are not even legally allowed to rent a car.

The Bankruptcy Myth Is Crumbling

For a long time people believed student loans were impossible to discharge in bankruptcy. That is changing but it is still incredibly difficult.

Recent data shows that borrowers who file for discharge now succeed 87% of the time. This is up significantly from just a few years ago. The improvement comes from new guidelines by the Departments of Justice and Education.

However there is a catch. 99% of student loan borrowers in bankruptcy never even ask the judge to consider discharging their debt. They assume it is impossible. While the door is cracking open slightly the burden of proof is still on you. You have to prove “undue hardship” which is a humiliating and difficult legal battle.

For a deeper explanation on why this debt is so sticky read Why Student Loans Never Stop.

The Real Numbers Behind the Gamble

Let’s look at the scoreboard. If college is a bet how many people are losing?

According to the Education Data Initiative, the numbers are staggering:

Total U.S. Student Loan Debt: $1.81 trillion

Number of Borrowers: 42.5 million Americans

Average Federal Debt: Roughly $39,547

The monthly payment reality is sobering. While some pay a manageable amount, nearly 9.4% of all student debt is delinquent. That means millions of people placed a bet and lost. They cannot afford to pay the House.

And the House is aggressive. Collections have resumed for defaulted loans. Wage garnishment is back on the table.

Casinos Teach Risk Better Than Colleges

It is ironic but casinos actually teach better financial lessons than universities.

Only gamble what you can afford to lose.

Understand the house advantage.

Cash out when you are ahead.

Colleges never teach these things. They do not teach Return on Investment (ROI) by major. They do not teach break even timelines. They do not teach exit strategies. Students are taught how to enroll not how to win.

The ROI Reality Not All Degrees Are Equal

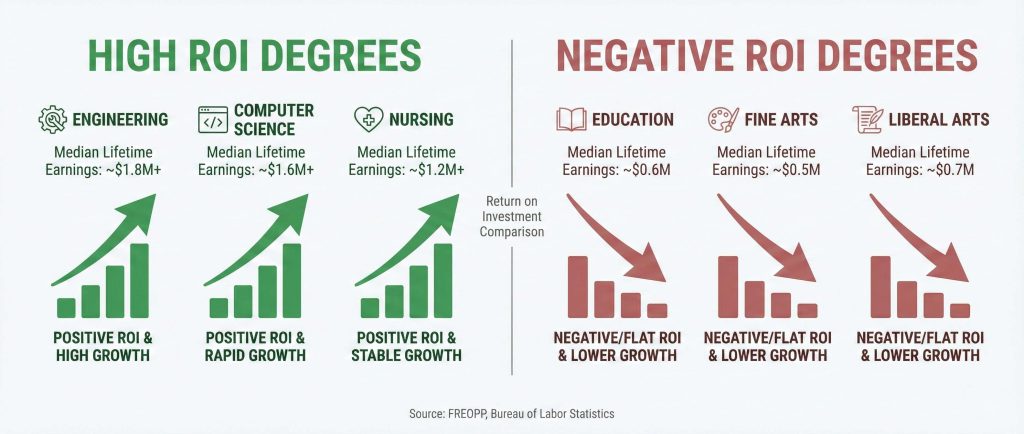

If you are going to gamble you should at least know which games have the best odds.

Research analyzing over 53,000 college programs reveals a harsh truth. 23% of bachelor’s degrees have a negative ROI. That means nearly one in four programs cost more than they will ever earn back. You would literally be financially better off never going to college at all.

This data comes from the Foundation for Research on Equal Opportunity (FREOPP), which conducted one of the most comprehensive studies on degree value.

The Winning Hands (High ROI)

Engineering: Median annual earnings of $72,000+ and a massive lifetime ROI.

Nursing: High demand and strong job security.

Computer Science: Six figure potential within 10 years.

The Losing Hands (Negative ROI)

Education: Negative 55% ROI. This is a tragedy. We charge teachers a fortune to learn how to teach and then pay them poverty wages.

Fine Arts: Often negative returns.

Liberal Arts & Humanities: Negative 43% ROI.

The difference between choosing Engineering and choosing Fine Arts can amount to millions of dollars over a lifetime. Yet 18 year olds are told to “follow their passion” without looking at the math.

For more on how education paths lead to these traps read Pursuit of Education Leading to Debt Traps.

Graduate School Is Doubling Down on a Bad Hand

If a Bachelor’s degree is a gamble, a Master’s degree is often a reckless “double down.”

Many students graduate, cannot find a job, and decide to go back to school. They borrow more money hoping that a higher degree will fix the problem.

Data shows that nearly half of Master’s degree programs fail to pay off. The costs are higher. The interest rates are higher (Graduate PLUS loans are expensive). And the job market boost is often smaller than expected.

The Smarter Play Education Without Financial Ruin

I am not anti education. I am anti blind betting. I am against walking into a casino and throwing your life savings on a spin of the wheel.

There are ways to get an education without risking financial ruin.

1. The Trade School Fast Track

Trade school is the cheat code to the American Dream right now.

Average Cost: $5,000 to $15,000 total.

Time to Complete: 6 months to 2 years.

Debt at Graduation: Minimal to Zero.

Compare that to the $100,000+ cost of a four year degree.

High Earning Trade Careers: According to the Bureau of Labor Statistics (BLS):

Electricians: Median pay over $60,000 with 11% job growth.

Plumbers: Strong demand and recession proof.

HVAC Technicians: Growing field as climate control becomes critical.

Read more about this alternative in Loan Forgiveness or Jump Into a Trade Apprenticeship?

2. Apprenticeships Earn While You Learn

This is better than a scholarship. An apprenticeship pays YOU to train.

Starting pay is often $15 to $20 an hour.

By your final year you earn $25 to $35 an hour.

Total earnings during training: $80,000 to $150,000.

By the time a college graduate enters the workforce with debt, an apprentice has banked over $150,000 in earnings and gained real world experience.

3. The Community College Strategy

If you must go to college do not pay premium prices for generic credits. Complete your general education requirements at a community college. It costs a fraction of the price. Then transfer to a university for the final two years. Your diploma looks exactly the same but your bank account looks much better.

The House Always Wins Unless You Change the Game

In my book The Pastor of the Student Loan Disaster, I talk about the “Gospel of Debt.” Society preaches that debt is good. They tell you it is an investment.

But an investment has a return. A gamble has a risk.

If a casino operated like higher education regulators would shut it down. Warning labels would be mandatory. Parents would protest outside the building.

Yet we keep sending 18 year olds to the most expensive table in America. We give them borrowed money. We give them no exit plan. And we act surprised when they lose.

Conclusion Who Is Really Winning?

College is no different than a casino except in a casino you can actually win money. In college you must earn it after you have already lost.

The goal is not to avoid education. The goal is to avoid becoming the House’s guaranteed loser.

You have the power to count cards. You can research ROI. You can choose a Trade. You can minimize debt. You can refuse to play the game by their rules.

Don’t be a gambler. Be an investor. Invest in skills. Invest in certainty. And never bet your future on a hand you cannot afford to lose.

Need a strategy to beat the house? If you are currently looking at colleges or dealing with debt you need a plan. Get my book Chadwick’s College Checklist. It gives you the proven strategies to reduce costs, find funding, and walk away a winner.

FAQs

From a risk perspective yes. Both require upfront money with uncertain outcomes. The key difference is transparency. Casinos publish odds while colleges rarely disclose job placement rates or true ROI by major.

It depends on the major and the total cost. Degrees tied to clear labor demand like Engineering or Healthcare can pay off. High cost degrees with low earning potential often do not. Use the College Scorecard to research specific programs before enrolling.

Student loans cannot easily be discharged in bankruptcy. They accrue interest over decades. They reduce home buying power and retirement savings. They follow borrowers even during unemployment. This makes them high risk debt.

Research consistently shows that Education, Liberal Arts, and Fine Arts often struggle financially. According to the Foundation for Research on Equal Opportunity, some of these degrees have a negative ROI meaning they cost more than they earn.

Best practices include using Community College for general education, choosing in state public universities, and applying for scholarships. You should always try to borrow less than your expected first year salary.

Trades are not better or worse but they are often faster and debt free. Many skilled trades offer immediate pay, zero tuition apprenticeships, and strong job security. For many students trades offer a stronger financial starting position than a degree.

Yes the landscape has changed significantly. Borrowers who pursue discharge now succeed 87% of the time thanks to streamlined federal guidelines. However most borrowers still do not attempt this because they believe the old myth that it never works.