Introduction

Student loan debt is one of the most debated financial topics in America. With more than 40 million borrowers carrying loans, many wonder: Does student debt only bring stress, or can it also create success?

This in-depth guide explores the emotional, financial, and career impact of student loans, while offering practical repayment strategies and highlighting ways to turn debt into opportunity. You’ll also discover Charles A. Chadwick Jr.’s proven 40% cost-saving methods, see a comparison table of stress vs. success, and listen to our podcast episode that digs deeper into this important discussion.

The Reality of Student Loan Debt Today

The cost of higher education has outpaced wages for decades. According to the Federal Reserve, U.S. borrowers now owe more than $1.7 trillion in student debt, making it the second-largest form of consumer debt after mortgages.

This massive financial burden shapes lives in ways most people don’t realize:

- Many graduates postpone buying homes because loan payments consume disposable income.

- Some delay marriage or starting families due to financial instability.

- Entrepreneurs often hold back from launching businesses while weighed down by debt.

Beyond finances, the stress of owing money for decades can deeply affect mental health. Surveys have found that borrowers report higher levels of anxiety, depression, and sleep problems compared to peers without loans.

Read more: Why Schools Don’t Teach Money Management

Why Student Loans Create Stress for Many

The Weight of Repayment Plans

The average graduate leaves school with over $30,000 in debt. Monthly repayment plans often stretch over 10–20 years, limiting financial flexibility. Even those who find good jobs often spend years struggling to balance debt with other priorities like rent, healthcare, and saving.

Interest Rates and Long-Term Financial Strain

Compounding interest can feel like quicksand. Even if you make minimum payments, the balance sometimes decreases so slowly it feels impossible to escape. Some borrowers end up paying double the original amount borrowed over the life of the loan.

Explore further: Student Loans: High Interest Rates—Should You Consolidate?

The Emotional and Social Toll

Debt has an invisible emotional price:

- Anxiety: Borrowers live under constant pressure of repayment.

- Delayed life goals: Marriage, homeownership, and even retirement savings often get postponed.

- Stigma: Many borrowers feel embarrassed or guilty about their debt, making it a silent burden they rarely discuss.

Can Student Loans Lead to Success?

While stressful, student loans aren’t always negative. Managed strategically, they can lead to long-term benefits.

Building Resilience and Discipline

Debt teaches hard lessons in budgeting, sacrifice, and perseverance. These financial habits, while formed under pressure, can benefit individuals for life.

Degrees with Strong ROI

Not all degrees are equal. Fields such as medicine, engineering, law, and computer science often require high upfront costs but offer salaries that justify the debt. For graduates in these fields, student loans can be an investment rather than just a burden.

Pathways to Career Growth

In some cases, student loans make it possible to attend institutions or programs that open doors to better careers. When approached with a clear plan, debt can serve as a stepping-stone to long-term success.

See more: Was College Worth It?

Podcast Spotlight: Stress vs. Success in Student Debt

Our podcast episode, explores this topic from different angles—stress, resilience, and opportunity.

3 Key Insights from the Episode:

- Debt often brings stress, but it also forces financial discipline.

- Smart repayment strategies significantly reduce long-term pressure.

- Success is possible—even with debt—when students take proactive steps early.

Balancing Stress and Success

Practical Stress-Management Strategies

- Zero-Based Budgeting: Assign every dollar to a purpose—bills, savings, or repayment. This ensures no money goes to waste.

- Side Hustles & Freelancing: Tutoring, delivery services, or online gigs can provide extra income that goes directly toward loan repayment.

- Mindset Shifts: Instead of viewing debt as punishment, treat it as a financial tool. This mental reframing reduces stress.

Alternative Education Paths

Not everyone needs a traditional four-year degree. Trade schools, apprenticeships, and certifications often provide solid incomes without massive debt.

Learn more: Tired of College Debt? Try Trade Skillset

Building Skills Beyond Degrees

Practical skills like coding, design, or digital marketing can create career opportunities that don’t require student loans. Many industries value real-world expertise just as much as a diploma.

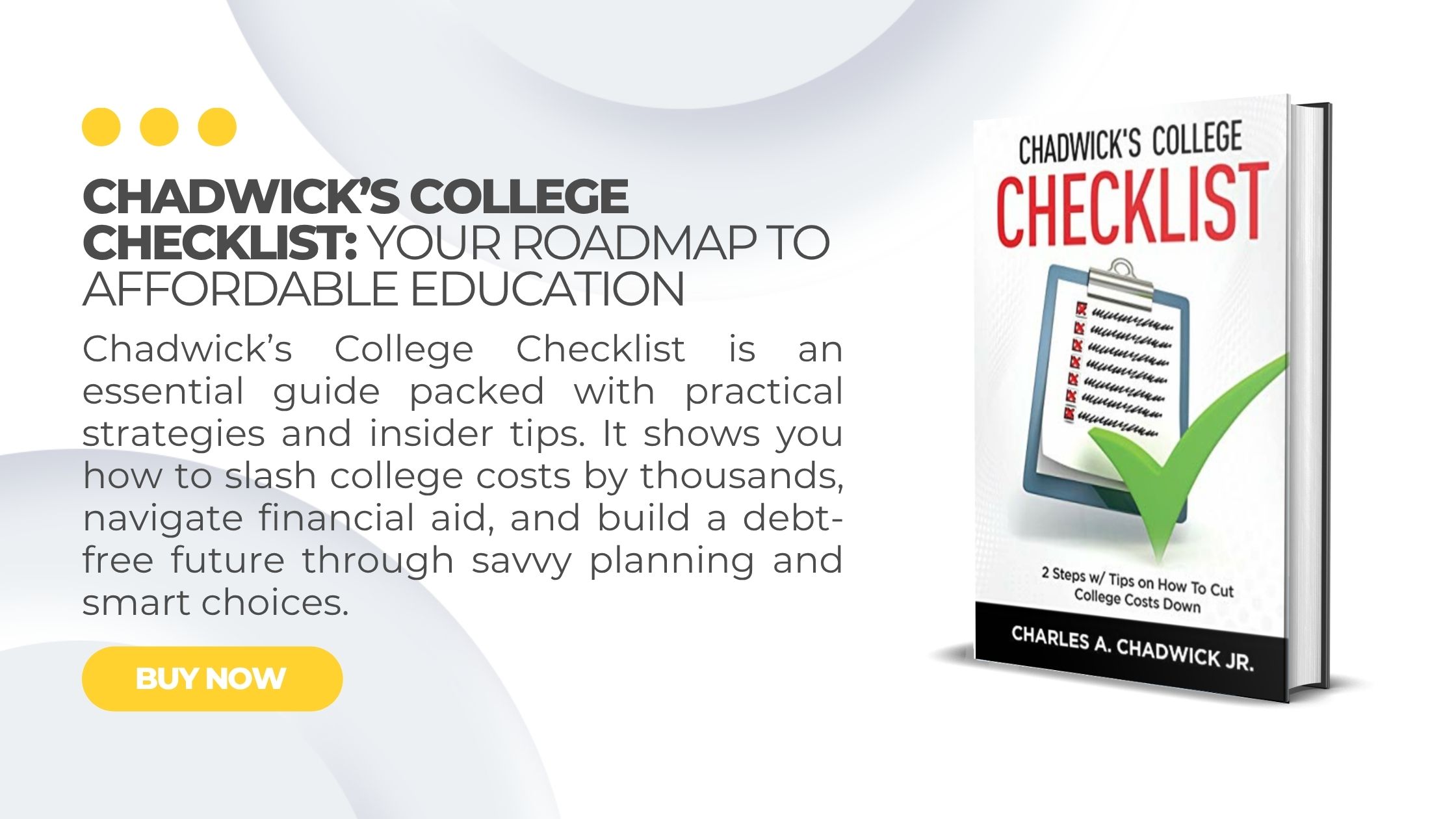

Smarter Ways to Approach Student Debt

Charles A. Chadwick Jr. managed to reduce his education costs by 40% while completing two degrees. His book Chadwick’s College Checklist outlines methods for:

- Cutting tuition costs significantly.

- Living affordably on or near campus.

- Avoiding unnecessary student fees.

- Managing food, housing, and books wisely.

These strategies show that waiting for forgiveness isn’t the only answer—students can take control immediately.

The Forgiveness Debate

Does Forgiveness Solve the Problem?

Forgiveness may relieve individual borrowers, but it doesn’t address the root cause: why college costs continue to rise faster than wages.

Political Promises vs. Reality

While student loan forgiveness has been part of political campaigns for years, large-scale cancellation remains uncertain.

Dive deeper: Will Student Loan Forgiveness Happen?

Alternatives to Waiting

- Refinancing loans for lower interest rates.

- Choosing income-driven repayment plans.

- Making extra payments when possible to shorten repayment time.

Practical Repayment Strategies

Repaying student loans doesn’t have to feel endless. Popular approaches include:

- Snowball Method: Tackle the smallest debts first for quick wins and motivation.

- Avalanche Method: Focus on the highest-interest loans to save more long-term.

- Employer Assistance Programs: Many companies now offer student loan repayment as a perk.

- Freelancing & Online Work: Teaching English abroad, creating content, or freelance work can accelerate repayment timelines.

Student Loan Stress vs. Success: A Comparison

Factor | Stress Impact | Success Potential |

Monthly Repayments | Creates financial pressure | Builds discipline & budgeting habits |

Interest Rates | Long-term financial drag | Motivation to refinance or pay early |

Mental Health | Anxiety, depression | Resilience & problem-solving skills |

Career Opportunities | Restricts flexibility | High-demand degrees justify cost |

Financial Growth | Delayed savings & investing | Encourages financial literacy |

How Student Loans Affect the Bigger Picture

Student debt isn’t just a personal issue, it impacts the economy.

- Lower homeownership rates: Millennials with heavy debt often delay buying homes.

- Fewer entrepreneurs: Debt makes graduates risk-averse.

- Widened wealth gap: Studies show that student debt worsens racial and generational inequality.

Reference: Brookings Institution – The Student Debt Crisis

Financial Literacy: The Key to Turning Stress Into Success

The best way to reduce debt-related stress is through financial literacy. When students understand budgeting, saving, and return on investment, they make better education and career choices.

Read more: Forbes – How Student Loans Affect Mental Health

Conclusion: Stress or Success?

So, does student loan debt create stress or open doors to success? The truth is—it can do both.

For some, debt becomes a heavy chain, delaying milestones and fueling anxiety. For others, it becomes a stepping-stone to career opportunities, financial discipline, and resilience. The difference lies in how you manage it, the strategies you apply, and the mindset you adopt.

Listen to our podcast episode to hear practical stories and insights. Keep learning with more articles on our site to build financial confidence and turn challenges into opportunities. Explore Our Books for proven methods to cut education costs and get Financial Freedom.

Student loan debt doesn’t have to define your future, it can shape your success if you take control today.

FAQs

Not always. While many borrowers feel pressure, others see debt as an investment in their future.

Yes. Managed wisely, loans can support higher salaries and financial growth.

Budgeting, side hustles, refinancing, and financial literacy are essential.

Uncertain. Some programs exist, but large-scale forgiveness remains politically debated.

I really like reading through a post that can make men and women think. Also, thank you for allowing me to comment!

Thanks for your comment and supporting Chadwick’s Experiences.