Introduction: The Hidden Truth About Student Loan Co-Signing

When college dreams meet financial reality, parents often feel pressured to step in. One common way is co-signing student loans. At first, it feels supportive—a loving parent ensuring their child can attend the school of their choice.

But here’s the truth most families never hear: co-signing can do more harm than good. While it may open doors in the short term, it can also create long-term financial stress for both the student and the parent.

This article explores the risks of student loan co-signing, real-life stories, and expert insights. More importantly, it shows why parents who say “no” may actually be giving their child the greatest gift—financial independence.

The Basics: What Does It Mean to Co-Sign a Student Loan?

A co-signer is someone usually a parent, who agrees to take equal responsibility for a student loan. That means:

- If the student can’t make payments, the co-signer must step in.

- The loan shows up on the co-signer’s credit report.

- Any missed or late payments hurt both the student’s and co-signer’s credit scores.

According to Investopedia, co-signing is not a light favor—it’s a serious financial commitment that can last decades.

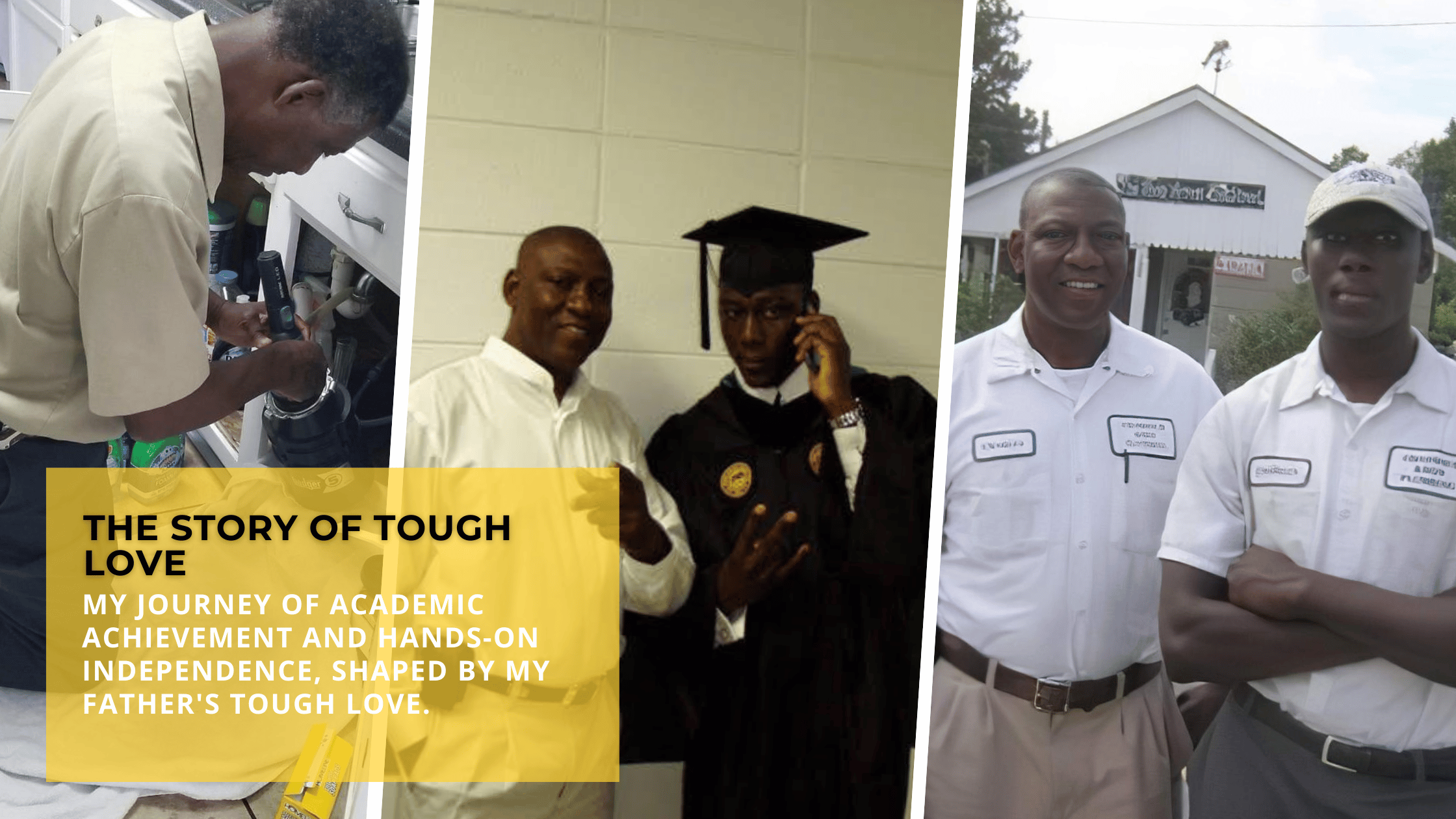

A Story of Tough Love That Paid Off

Charles A. Chadwick Jr., author and financial literacy expert, once faced this very situation. As a young college student, he asked his father to co-sign a loan. His father refused.

At the time, Charles felt frustrated. But that single “no” forced him to:

- Budget carefully.

- Apply for scholarships.

- Work part-time while in school.

- Avoid unnecessary debt.

The result? He reduced his overall college costs by 40%, earned two degrees, and built a foundation for financial independence. Here’s a glimpse of my journey from earning my degree and working alongside my father to mastering practical skills that paved the way for financial independence, thanks to a single, powerful “no.”

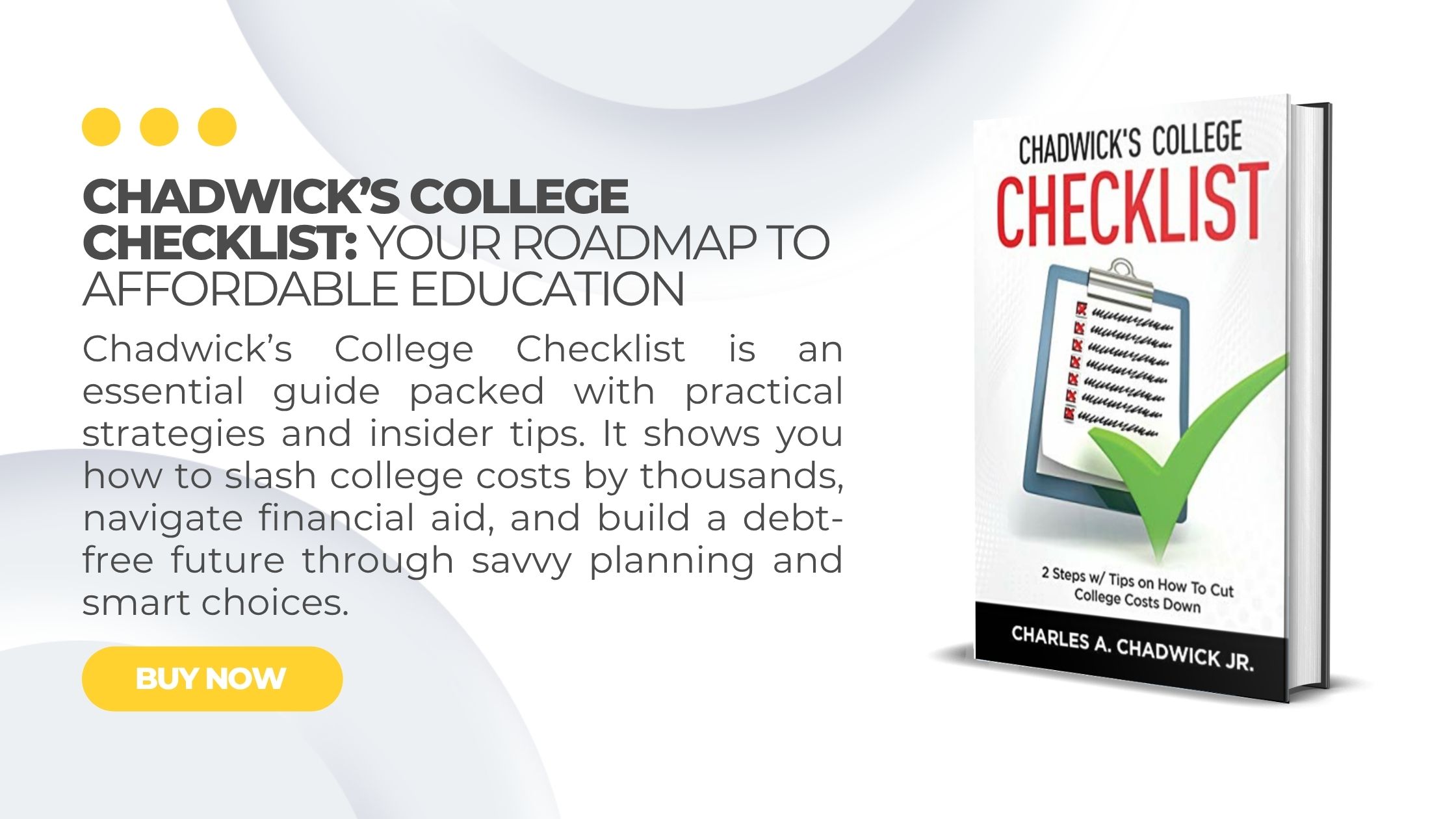

For practical strategies like this, Charles shares more in his book Chadwick’s College Checklist, where he explains step-by-step methods to cut college costs dramatically.

The Alarming Statistics on Student Loan Co-Signing

The numbers tell a sobering story:

- Over 90% of private undergraduate loans require a co-signer.

- 66% of parents who co-sign later end up helping with payments.

- 45% of parents report their child missed or was late on payments.

- 51% of parents fear co-signing will delay retirement.

- Just one late payment can lower a parent’s credit score by up to 129 points (Source: PNC Financial)

Clearly, co-signing is not just a student’s burden—it’s a family burden that can stretch across generations.

Real-World Examples: Love vs. Liability

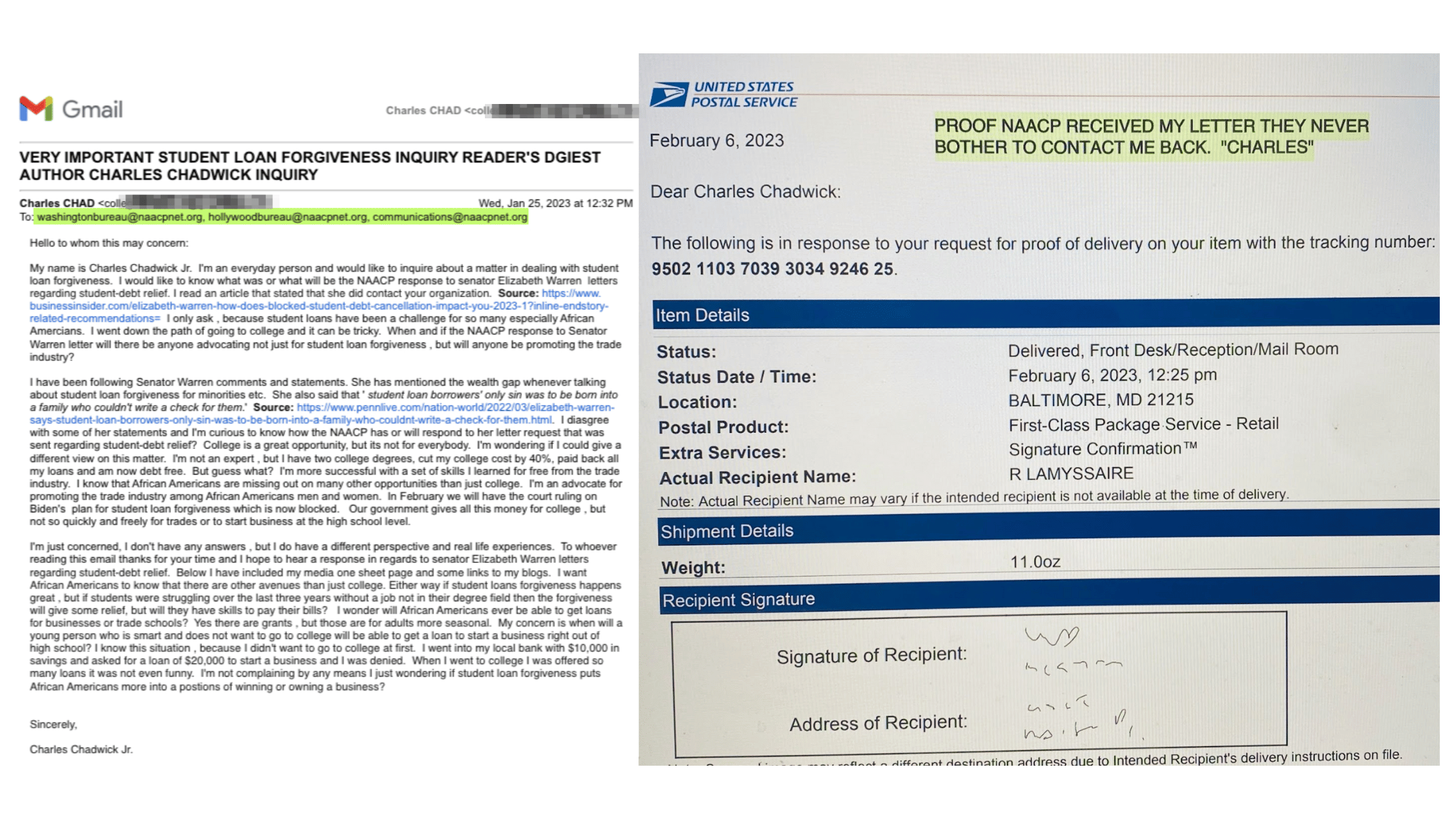

Amari’s Story – The NAACP Case

A mother co-signed $140,000 in loans for her daughter. What started as an act of love quickly became a financial nightmare, leaving both mother and daughter trapped under crushing debt.

Charles has personally written to the NAACP multiple times regarding Amari’s story and never received a response. (See copy of letter/email Charles sent.)

This heartbreaking situation shows how co-signing can unintentionally chain two generations to the same financial struggle. (Related article: Rising College Costs)

50 Cent’s Public Stand

Even rapper 50 Cent made headlines for refusing to financially support his adult son. His controversial decision sparked debate, but it raised an important question: when should parental responsibility end?

While opinions vary, many financial experts argue that enabling adult children with unlimited support can stunt independence instead of fostering it.

The Philosophical Question: When Does Adulthood Really Begin?

Traditionally, turning 18 meant independence. Today, that definition has shifted:

- Only 24% of young adults are financially independent by age 22.

- Most Americans believe true adulthood begins at age 27.

- Just 44% of adults aged 25–29 are financially independent.

- Many Gen Zers expect independence closer to age 32. (Pew Research)

In other words, co-signing may delay adulthood by cushioning financial responsibility instead of encouraging it.

Why Saying “No” Can Be the Best Gift

Parents often worry that refusing to co-sign will seem unsupportive. In reality, a firm “no” can create powerful opportunities for growth.

Benefits of Parents Saying No to Co-Signing

- Encourages students to seek scholarships and grants.

- Pushes students toward part-time jobs and budgeting skills.

- Protects parents’ credit and retirement security.

- Reduces financial dependency between generations.

- Builds resilience and independence in students.

Charles Jr.’s experience proves that saying “no” isn’t harsh—it’s a form of tough love that pays dividends for life.

In his book The Pastor of the Student Loan Disaster, Charles combines humor with wisdom to show how students can escape debt traps and build financial freedom without relying on parents.

Alternatives to Co-Signing a Student Loan

If parents say no to co-signing, what can students do instead? Here are better options:

- Federal Student Loans – Unlike private loans, federal loans usually don’t require a co-signer and offer flexible repayment plans.

- Scholarships and Grants – Billions of dollars go unclaimed each year. Students can apply early and often.

- Work-Study Programs – On-campus jobs allow students to earn while learning.

- Community College First – Reduces costs by thousands before transferring to a 4-year school.

- Employer Tuition Assistance – Many companies help employees pay for college.

- Trade Skills – As Charles writes, learning a trade can provide a strong income without heavy debt. (Read more: Tired of College Debt? Try a Trade Skillset)

Conclusion: More Pros Than Cons in Saying No

At first glance, saying “yes” to co-signing looks like support. But the data, real stories, and expert advice reveal a different truth: parents take on huge risks while students lose valuable lessons in financial independence.

By saying “no,” parents actually protect themselves and empower their children to grow, adapt, and succeed. Co-signing may seem like love, but sometimes the strongest love is setting financial boundaries.

If you’re a parent or student navigating this tough decision, remember: saying “no” today could mean a stronger, debt-free tomorrow. Want proven strategies to cut costs and avoid debt? Explore Chadwick’s College Checklist for practical methods to save up to 40% on college expenses.

FAQs

Parents should consider co-signing only if they are financially stable and fully prepared to make payments if the student defaults. Experts recommend exploring all alternatives first.

Yes, some private lenders offer a co-signer release after a certain number of on-time payments, but approval is not guaranteed.

Co-signers risk damaged credit, delayed retirement savings, and being legally responsible for the full debt if the student fails to pay.

Students can pursue federal loans, scholarships, grants, trade school options, or part-time jobs to cover costs without needing a co-signer.