Introduction: Why Mentorship Matters for the Young Generation

What if you could achieve your goals in half the time? In today’s fast-paced world, young people face enormous pressure to succeed quickly. The competition is fierce, and the path to success often feels unclear. This is where mentorship becomes a game-changer.

Learning from experienced mentors – regardless of gender – can dramatically accelerate your journey to success. These seasoned professionals and life coaches offer something invaluable: wisdom earned through decades of real-world experience. They’ve already made the mistakes, learned the lessons, and discovered the shortcuts that can save you years of trial and error.

The benefits of mentorship extend far beyond career advice. Mentors help you avoid costly mistakes, gain insider knowledge about industries and life decisions, and build the confidence needed to tackle challenges head-on. They provide a roadmap based on proven strategies rather than guesswork.

Ready to accelerate your success? Click here to connect with a mentor now!

Research consistently shows that mentored individuals achieve their goals faster and with greater satisfaction. When you tap into the collective wisdom of those who’ve walked the path before you, you’re not just learning – you’re fast-tracking your success.

The Power of Wisdom from Experience

Experienced mentors bring something no textbook or online course can provide real-world wisdom earned through decades of navigating life’s challenges. These individuals have weathered economic downturns, career transitions, relationship challenges, and personal setbacks. Their perspective is invaluable because they’ve lived through the very situations you’re currently facing.

Consider the unique value older generations offer. They’ve witnessed technological revolutions, economic shifts, and social changes that younger people have only read about. This broad perspective helps them guide you through challenges like career choices, financial planning, and life transitions with a depth of understanding that comes only from experience.

A compelling 2019 study revealed that mentored professionals are five times more likely to receive promotions compared to their non-mentored peers. This statistic isn’t just about career advancement – it reflects the comprehensive development that occurs when someone invests in your growth.

Mentors also bring emotional maturity to the table. They’ve learned to manage stress, handle rejection, and maintain perspective during difficult times. This emotional intelligence is often the difference between those who succeed and those who give up when faced with obstacles.

The wisdom from experience isn’t just about avoiding mistakes – it’s about recognizing opportunities. Experienced mentors can spot potential in situations where you might see only problems. They understand market cycles, human behavior patterns, and the long-term consequences of short-term decisions.

Related: Why Schools Don’t Teach Money Management

Common Mistakes Young People Make (and How Mentors Help Avoid Them)

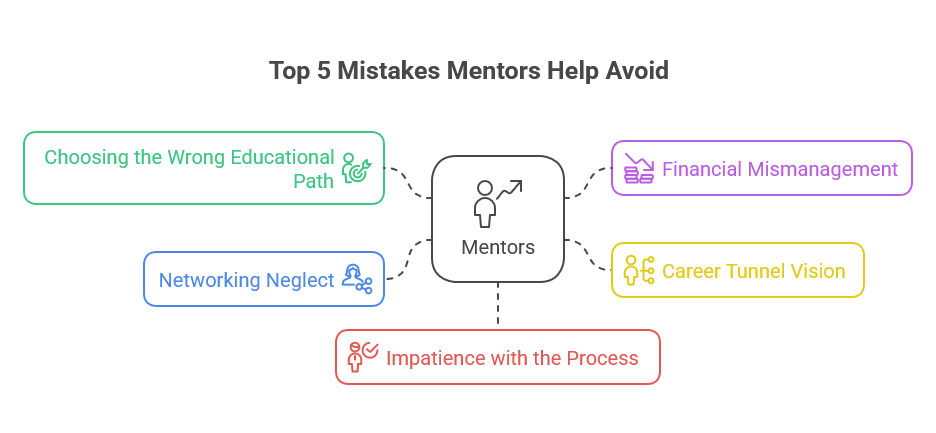

Young people often stumble into predictable traps that mentors can help them avoid. These mistakes aren’t character flaws – they’re natural consequences of inexperience. However, with proper guidance, you can sidestep these pitfalls entirely.

Top 5 Mistakes Mentors Help You Avoid:

- Choosing the Wrong Educational Path: Many students select majors based on trends or parental pressure rather than their strengths and market demand. Mentors help you evaluate your natural abilities against real career opportunities.

- Financial Mismanagement: Young adults often accumulate unnecessary debt or miss early investment opportunities. Mentors provide practical budgeting strategies and investment guidance.

- Career Tunnel Vision: Focusing on one narrow path without exploring alternatives can limit your potential. Mentors help you see the bigger picture and identify multiple pathways to success.

- Networking Neglect: Many young professionals underestimate the importance of building relationships. Mentors teach you how to network authentically and maintain professional connections.

- Impatience with the Process: Expecting immediate results often leads to poor decision-making. Mentors help you understand that sustainable success takes time and strategic planning.

Consider Sarah, a college student who was pursuing a pre-med track despite struggling with chemistry and having no genuine interest in medicine. Her mentor, a healthcare administrator, helped her recognize her strengths in healthcare management instead. This guidance saved Sarah four years of medical school and led her to a fulfilling career in hospital administration.

Mentors provide clarity by sharing real-world insights that you won’t find in career counseling offices. They know which industries are growing, which skills are becoming obsolete, and how to position yourself for future opportunities.

Explore: Student Loaners Movement: A New Playbook to Break College Debt

Financial Literacy: Learning Money Management Early

Financial literacy is one of the most crucial skills young people can develop, yet it’s often overlooked in traditional education. This is where mentors become particularly valuable, offering practical money management wisdom that can save you decades of financial stress.

The power of compound interest makes early financial education incredibly important. Money invested in your twenties has exponentially more growth potential than money invested in your forties. A mentor who understands this principle can help you start building wealth immediately, rather than waiting until you’re “ready.”

Recent surveys show that 60% of Gen Z wants financial education but lacks access to quality resources. Mentors fill this gap by sharing practical tips that go beyond theoretical knowledge. They teach you how to create realistic budgets, avoid debt traps, and identify legitimate investment opportunities.

3 Financial Habits to Start in Your 20s:

- Automate Your Savings: Set up automatic transfers to save at least 20% of your income before you’re tempted to spend it.

- Build Multiple Income Streams: Develop side hustles or passive income sources to reduce dependence on a single job.

- Invest in Appreciating Assets: Focus on stocks, real estate, or skills that increase in value over time rather than depreciating purchases.

Mentors also help you understand the psychological aspects of money management. They’ve learned to distinguish between wants and needs, avoid lifestyle inflation, and make financial decisions based on long-term goals.

Also read: Was College Worth It?

Learn from Chadwick’s Own Experience

In Chadwick’s powerful interview with the author of “Man Must Be Qonquered VOL 1: Unlocking Chambers CqH“, real-life mentorship is at the forefront. These conversations between men just slightly older than the youth reflect hard-earned financial lessons, emotional resilience, and a roadmap to success.

For more information on the book and personal growth tools, visit Qonquer’s Official Website.

Feeling stuck financially or in life? Find a mentor tailored to your goals and take the first step.

Conclusion: Start Listening, Start Winning

The evidence is clear: mentorship provides a significant advantage in achieving your goals faster and more efficiently. Experienced mentors offer wisdom that can save you years of trial and error, help you avoid costly mistakes, and guide you toward opportunities you might never have discovered alone.

The benefits extend beyond career advancement to include financial literacy, emotional resilience, and personal development. Mentors provide not just knowledge, but perspective – the ability to see the bigger picture and make decisions based on long-term success rather than short-term gains.

Ready to master your student loans like a championship game? Get exclusive early access to Charles Chadwick’s upcoming book ‘The Student Loaners: Are You A Winner or Loser?’ – where financial strategy meets the winning playbook of basketball! Reserve your copy now

FAQs

A financial literacy mentor is someone with real-world experience who guides students in making smart money decisions, like budgeting, saving, and investing.

Mentors help students avoid common financial mistakes, navigate career paths, and build emotional resilience during stressful transitions.

Yes, many schools, non-profits, and community organizations offer free mentorship opportunities. Online platforms like SCORE and LinkedIn are also great resources.

Mentors educate students on the realities of student loans, encourage smart borrowing, and promote early saving habits.

Mentorship is personalized and experience-based. Unlike generic advice, a mentor tailors their guidance to your unique goals and situation.